You can buy a foreclosed property in Japan as a foreigner

Yes, foreigners have exactly the same right as locals to buy foreclosed properties in Japan, and they are often auctioned out at a steep discount compared to their market value

What few foreigners, and even Japanese people know is that foreclosed properties in Japan can be purchased by anyone.

In fact, almost all properties that have been seized due to non-payment of mortgages or unpaid taxes will be put up for auction. Therefore, you will be able to purchase a property through an auction much cheaper than on the normal housing market. Even for attractive properties, about 70% of the market price is the norm for foreclosed homes!

However, purchasing a foreclosed property also has some considerable risks…

In this article, I will teach you how to buy a foreclosed property in Japan and the most common pitfalls.

Table of Content

How does a property foreclosure occur in Japan?

Different types of foreclosed properties

How to buy a foreclosed property

Things to keep in mind when buying a foreclosed property

Foreclosed properties for sale now

Final takeaways

1. How does a property foreclosure occur in Japan?

First, let me explain what a foreclosure of a property is. Generally speaking, most people think that a foreclosure means that a property has been sized forcibly. However, a foreclosure does not mean that property is confiscated immediately.

In Japan, debtors are prohibited from disposing of or selling the property without permission once the property is seized.

The purpose of a seizure is to collect the money that is in arrears, such as the court. For that reason, property after seizure can be sold at auction or public sale only if cash cannot be collected any other way.

The most common type of foreclosure in real-estate is mortgage delinquency.

If you fall behind in payments for several months and is not able to offer any collateral payment, you will lose your right to your property.

What happens when you’re delinquent on your mortgage?

The chain of events that happens when a property goes up for foreclosure auction:

First, the payment on a property is delayed.

Second, if payment is not received after months of reminders, additional fees for late interest fees and breach of contract activated.

Third, bulk payment from bank requested for outstanding loans

Fourth, the guarantor company for property is asked to repay the remaining loans.

Fifth, the guarantor company initiates repossessing the property.

Sixth, the property owner either agrees or fights the case.

Lastly, auction of the property starts.

As for what items are subject to seizure, cash or items that can be converted into cash include real-estate, movable property, and receivables.

Worth noting is that if a property ends up on a foreclosure auction, it is often because the previous property owner was not willing/able to sell it himself. Hence, not all properties from illiquid property owners end up on a foreclosure auction. However, as sales of properties incur additional taxes and work from the property owner, a lot of them choses to give up their rights to their property even if a sale on the normal market would have given them more money.

2. Different types of foreclosed properties

All foreclosed properties in Japan are sold off on auction. Although these properties are seized and auctioned off as quickly as possible, the seizer need to guarantee that there are no serious problems with them.

Another advantage of auction properties is the simplicity of the process.

When purchasing a second-hand property normally, various procedures such as ownership transfer registration are required, but for auction properties the court will handle it.

However, unlike ordinary property purchases, auction properties are purchased in a special procedure. First off, because the auction property is treated as if the seller does not exist.

In a normal sale of property, there is a seller that will arrange the condition of the it so that it can be handed over properly. As the seller is absent in foreclosure auctions, there is no one responsible to do this. Therefore, it is quite possible that the property is given to you without being in a habitable state.

However, it is due to such circumstances that you can find such bargains on the Japanese foreclosure market.

Difference between a public auction and a private auction?

There are two ways to purchase a foreclosed property: Private auction and public auction. Both are open to the general public.

A private auction is a system in which private companies, such as financial institutions and credit loan companies, put the property up for sale by submitting a petition to the court.

Public auctions, on the other hand, are different in that they are conducted by the government, not by private companies, to collect a person’s outstanding taxes.

3. How to buy a foreclosed property

How to find foreclosed properties

As foreclosed properties are not sold through any private companies, you have to search for them on specific websites. Also, as this is quite a niche market space, you have to either know Japanese or be good at translating websites.

These are the most common websites for foreclosed properties:

Broadcast Information of Tri-set System (BIT) - This site has the following search methods, and it is easy to use even if you are buying an auctioned property for the first time:

Search by Region

Search by Court

Search by case number

Information center for foreclosed real estate properties on court auctions in Japan (981.jp) - This site is is easier to navigate, has a search function by prefecture, and even has an English version, but lack the depth of BIT

How to bid on a foreclosed property auction

In the world of Japanese property auctions, periodic bidding is the most common method used. Here's how it works:

Periodic Bidding: Prospective buyers prepare and submit their bids within a predetermined time frame. It's important to note that along with their bids, they also need to provide a deposit.

Bid Review: When the bidding day arrives, all the submitted bids are opened and reviewed simultaneously. The individual who has placed the highest bid becomes the winner of the property.

Sale Confirmation and Ownership Transfer: Following the bidding, once the sale gets authorized, the winning bidder pays the remaining balance. Subsequently, the process for the registration of property ownership transfer begins.

One notable aspect of the periodic bidding system is that it permits each bidder to place their bid only once.

Now, when we shift our focus to public auctions, we observe that they employ multiple methods for the bidding process. These include:

Periodic Bidding: Similar to private auctions, bidders get a single chance to bid.

Internet Public Auction: This is an online platform where bidding is carried out.

Voluntary Advertising Contract: In this unique method, an estimated price for the property is put forth in advance. The property is then sold to the first person who intends to purchase it for a price greater than the estimated price. Essentially, this method operates on a first-come, first-served basis."

4. Things to keep in mind when buying a foreclosed property

Foreclosed properties present unique circumstances compared to typical second-hand properties. They operate without the backing of a real estate company, leading to potential challenges that don't typically surface when purchasing used properties through regular channels.

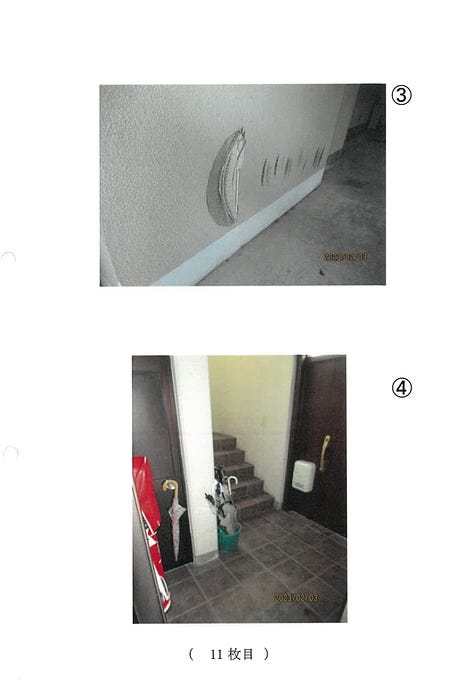

Issues might arise, such as occupants unwilling to vacate, or unknown property conditions due to limited inspection opportunities. Therefore, a solid understanding of these risks is a must when considering the purchase of a foreclosed property.

Inability to preview foreclosed properties

Foreclosed properties generally do not allow for previews, unlike traditional property purchases. The lack of a thorough interior examination means you run the risk of buying without a comprehensive understanding of the property's condition. To mitigate this risk, it is advisable to visit the property site to inspect the property's exterior.

Also, in an auction setting, the court usually releases key property-related documents, including the property description, current condition survey report, and valuation report. These documents provide valuable details about the property and insights from debtor interviews, which can inform the potential presence of occupants. However, this information could be several months old, indicating the possibility of changes in the property's status since the data was collected.

Deposits required for private & public auction

Both private auctions and public auctions necessitate a deposit. For private auctions, the deposit amounts to 20% of the standard sales price, whereas, for public auctions, it equates to 10% of the estimated price. Therefore, without the funds to cover these initial costs, you won't be eligible to bid.

Upon winning the auction, be prepared to promptly pay the remaining balance. One important consideration is whether the foreclosed property qualifies for a mortgage. Although mortgages were previously unavailable for such properties, recent changes to the Civil Execution Law have permitted mortgages on foreclosed properties. However, due to the short timeframe between winning the bid and the payment of the remaining balance, you should have already passed the mortgage loan screening process. This process is often more challenging with foreclosed properties than regular properties, so it's advisable to pay in full initially and then secure a loan.

No recourse for property defects

In contrast to typical property transactions where sellers can be held accountable for discrepancies between the contractual agreement and the property's actual condition, there is no such recourse for defects in foreclosed properties. If a defect is discovered, the previous owner cannot be held responsible, leaving you to bear any repair costs.

Ownership of residual items

Often, the previous owners of foreclosed properties leave items behind when vacating. However, you can't dispose of these items without permission as they legally belong to the debtor. Unauthorized disposal could lead to legal repercussions. This is usually not an issue if the property owner has willingly given up their property, but be aware of this legal obligation.

Increased risk with public auction properties

While all foreclosure properties carry inherent risks, public auctions can be particularly hazardous due to the scarcity of available information and lack of enforceability. Unlike private auctions that provide comprehensive property information, public auctions often leave bidders making decisions based on sparse data.

Moreover, there's no guarantee of eviction in a public auction. If the debtor refuses to leave the property, you'll have to instigate a separate court case to proceed with eviction, potentially leading to additional costs and complications.

Additional insights from a real estate appraiser

The court typically doesn't provide comprehensive assistance, leaving bidders to gather information independently. Both private and public auction properties require a deposit, necessitating a certain amount of upfront capital. On the bidding day, the highest bid wins the property, which can be an exhilarating experience.

Key considerations when purchasing foreclosed properties include the possibility of occupants resistant to eviction, inability to inspect the property, and the presence of items left behind by the previous owner. These residual items legally belong to the debtor, and unauthorized disposal can lead to legal consequences.

5. Foreclosed properties for sale now

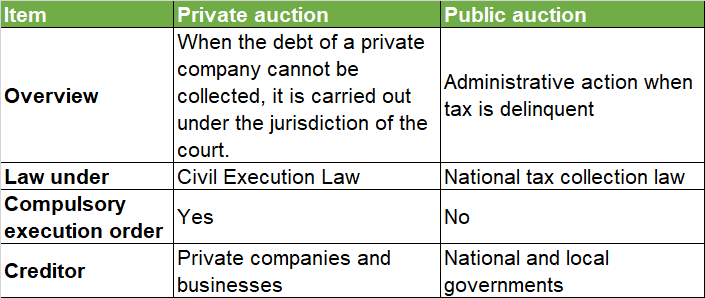

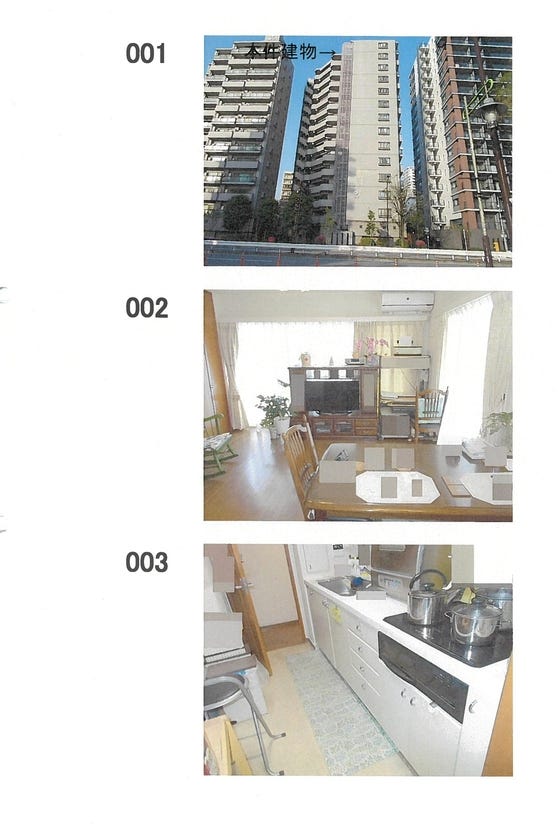

Apartment, Meguro, Tokyo [Link will be unavailable when property is sold]

Auction starting price: JPY 43,460,000 ($305,925)

Nearest station: Meguro Yamanote Station (900m)

Property data:

Type: Apartment building

Registered structure: Steel/concrete, flat roofed 14-story building

Floor: 7F

Floor Area: 81.73m2

Layout: 3LDK + walk-in closet

Land right: Ownership

Year/month built: 1999/03

Property images:

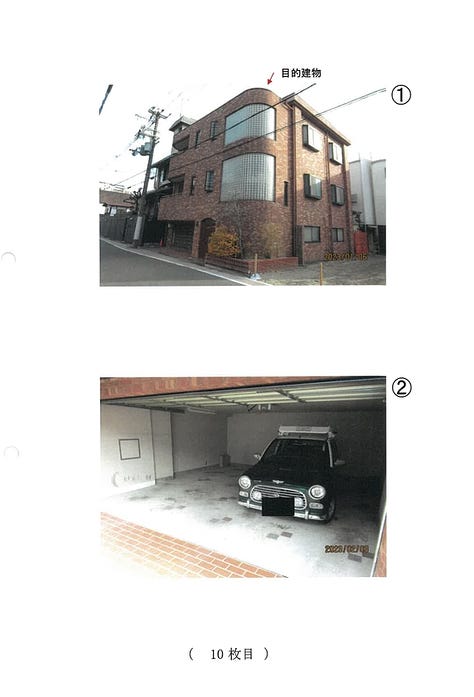

House: Abeno, Osaka [Link will be unavailable when property is sold]

Auction starting price: JPY 57,170,000 ($402,433)

Nearest station: Kitabatake Station, Osaka (210m)

Property data:

Type: Residential building with Garage

Registered structure: Steel/concrete flat, roofed 3-story building

Floor area: 124.06m2

Layout: 1〜2F:5LDK, 3F:3LDK

Land right: Ownership

Year/month built: 1996/11

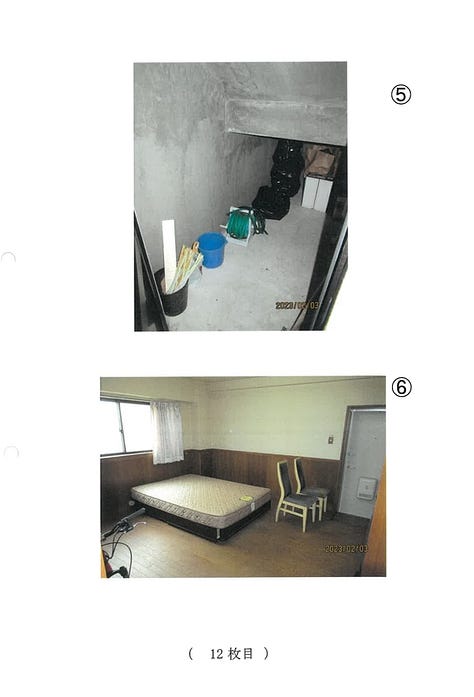

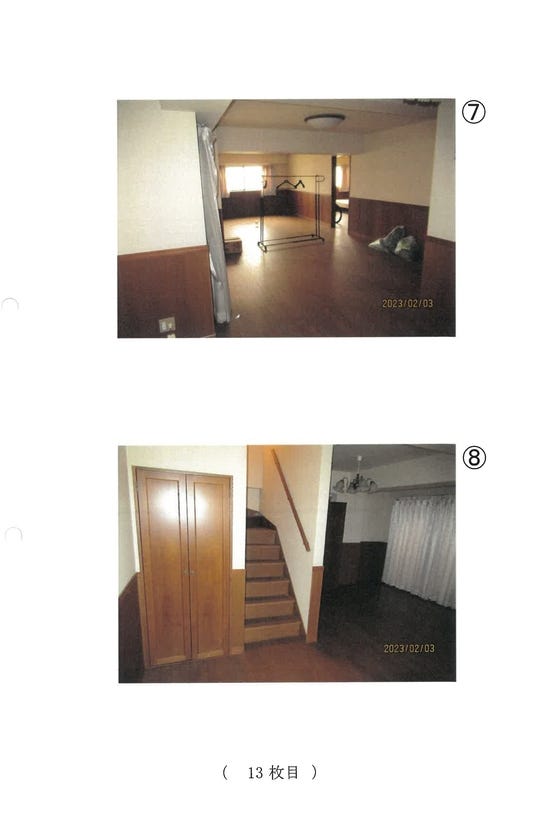

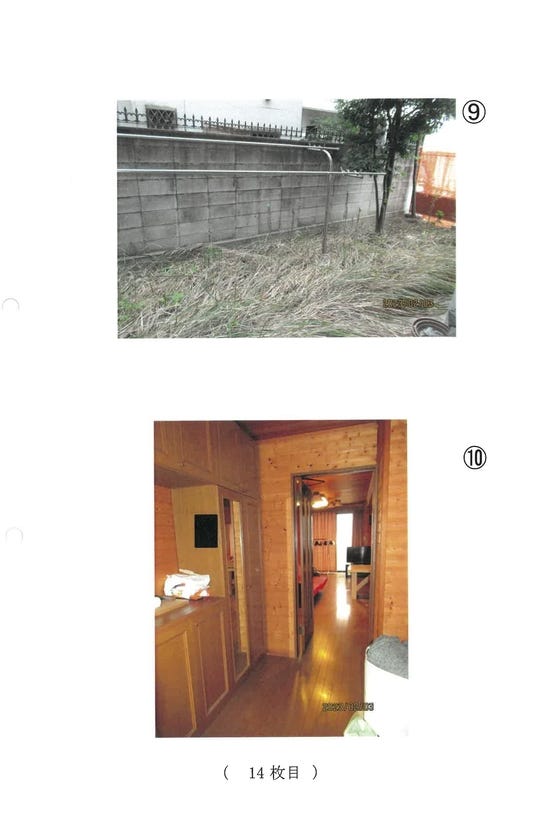

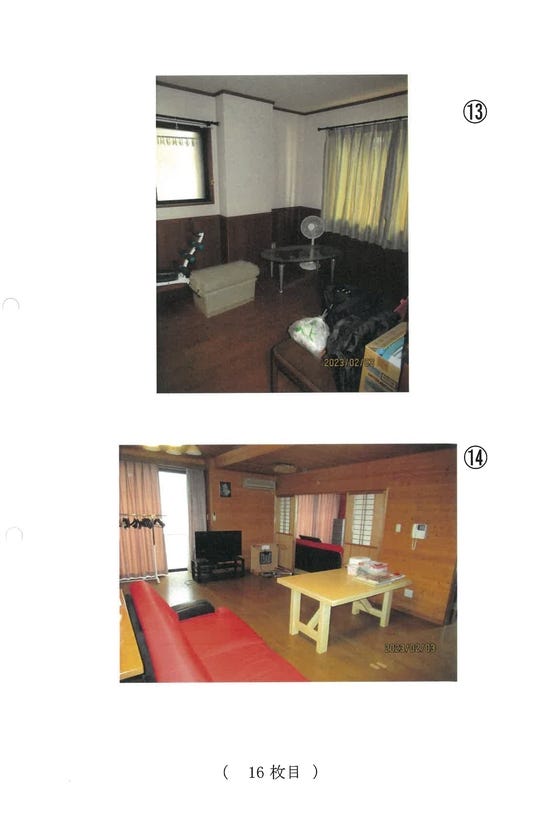

Property images:

6. Final takeaways

Foreclosures can occur through either court or governmental proceedings, depending on the circumstances. Private creditors, such as mortgage lenders, typically pursue court foreclosures when borrowers default on their loans. Conversely, the government initiates foreclosures due to unpaid taxes.

Properties repossessed by the court are usually sold via private auctions, while those seized by the government are sold through public auctions. Although both property types often come at a discounted price compared to regular used properties, they each entail varying degrees of risk.

Private auctions often come with associated documents detailing property information, and if the debtor refuses to vacate the property, an eviction order can be issued. As a result, they usually carry a lower risk level than public auctions. On the other hand, public auctions require self-sourcing of information, and evicting a resident may necessitate a separate legal action, but the increased risk also comes with bigger bargains.

In both private and public auctions, there is no party responsible for any defects in the property. Therefore, to avoid potential pitfalls, it's important to conduct thorough due diligence. This includes visiting the property site in advance and refraining from bidding on properties with insufficient information.

Equipped with this knowledge, you are now better prepared to navigate the nuanced landscape of buying a foreclosed property.

Happy hunting! With careful research and measured decision-making, you may just find that hidden gem you've been seeking!