TOTO (5332): The World's Best Toilet Maker

I’ve been watching TOTO for ages now, and let me tell you, they’re no ordinary toilet maker. They’ve raised bathroom culture to an art form...

Please note: This analysis is for informational purposes only and is not intended as investment advice. Mention of specific stocks is not a recommendation to buy or sell any securities.

Ever heard someone gush about a toilet?

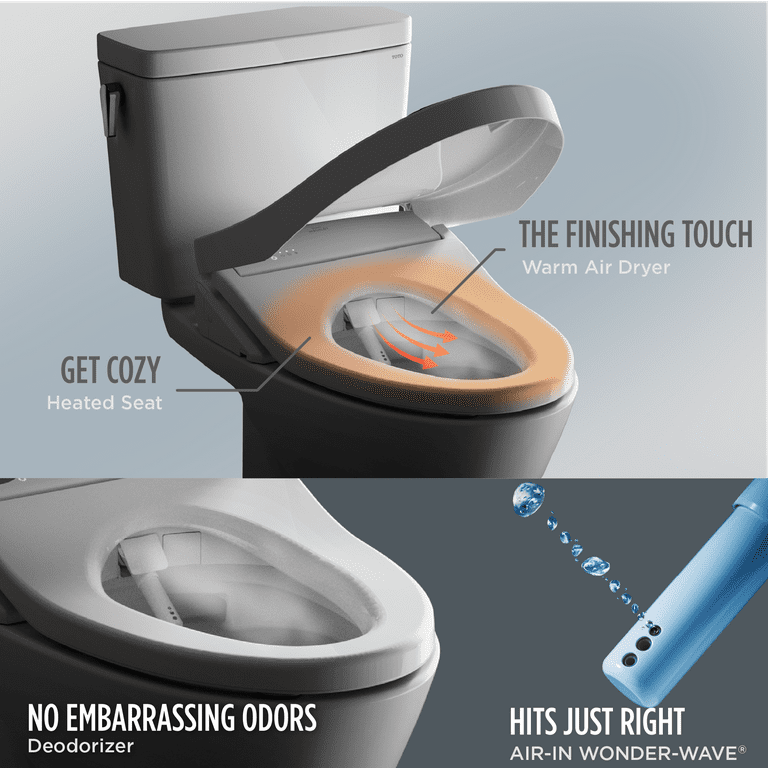

Visit Japan, use a TOTO washlet, and you’ll get it. From comfort-heated seats to immaculate “butt health,” TOTO redefines hygiene in a way that has turned many Western travelers into devoted fans.

Yet, I’ve stayed on the sidelines. Why? One word: Valuation. TOTO has often traded at a premium, and they’re heavily tied to the fortunes of China’s property market.

With China’s real estate scene in the pits, TOTO’s earnings have faced a tough flush 🥁.

Over the past five years, the stock is down over 17%, validating my caution. But now, as China’s market shows subtle signs of stabilization and global hygiene trends keep marching forward, is it finally time to give TOTO a second look?

Think about it: The global focus on cleanliness and personal care (still lingering post-Covid) might give TOTO fresh tailwinds. If Chinese demand recovers and TOTO manages its costs better, those legendary margins and top-tier engineering could shine again.

In my opinion, the company’s stellar brand and strong engineering DNA could justify a closer look, especially if the stock pulls back a bit from current levels. It’s not cheap, but long-term believers might consider nibbling if valuations get more reasonable.

Summary

Global Hygiene Pioneer: TOTO leads the high-end bathroom game, pioneering the washlet technology that others strive to imitate.

China Overhang: China’s real estate slump dented overseas profits, making management’s next steps in cost-reduction and strategic repositioning crucial.

Steady but Not Cheap: Trading around ¥4,076 with a P/E of ~18.46x, TOTO isn’t a value investor’s dream. Investors need to see signs that China restructuring and global demand will translate into earnings growth.

Future Potential: With ROE historically hovering around 9-10% (but currently closer to 7.8%), and a persistent premium multiple, any meaningful upside hinges on operational improvements and overseas normalization.

Key Numbers at the time of writing (2024/12/09):

Share Price: ¥4,076

P/E: ~18.46x

Dividend Yield: ~2.5%

1. Company Overview

2. Investment Thesis

3. Valuation

4. KonichiValue ScoreKeep reading with a 7-day free trial

Subscribe to KonichiValue Japan to keep reading this post and get 7 days of free access to the full post archives.