Disclaimer: The information in this article represents my opinions and should not be construed as individualized investment advice and are subject to change.

Semiconductors have gone from obscurity to something on everyone’s mind in just a couple of months. Ever since the beginning of the Covid 19-pandemic, whole industries have stopped working because of a shortage in them, and companies like Taiwan Semiconductor Manufacturing Company (TSMC) and ASLM have seen their share prices rising to the skies due to their importance in the field.

However, one company we have not heard much about is Tokyo Electron (TEL). Virtually every semiconductor in the world passes through one of Tokyo Electron's systems. Despite this, the company is still not that well-known among investors.

TL;DR

The semiconductor market size is expected to exceed about $1 trillion by 2030, more than doubling the level in 2020, providing a huge tailwind to Tokyo Electron.

The Japanese Yen is currently very weak, which is making shares of Japanese companies more affordable, and making companies that export equipment like Tokyo Electron more competitive.

Shares are trading at a very reasonable valuation, despite the company guiding for significant growth for its fiscal 2023 (April 1, 2022- March 31, 2023) with net sales expected to increase by ~17%.

What is Tokyo Electron and why is it so interesting?

Tokyo Electron (TEL) is mainly engaged in the manufacture and sale of electronic products for industrial uses. The Company operates in two segments:

The Semiconductor Manufacturing Equipment segment is engaged in the provision of wafer probers and other semiconductor manufacturing equipment.

The Flat Panel Display (FPD) Manufacturing Equipment segment consists of coater developer for flat panel display manufacturing, etching and ashing equipment.

The Company is also engaged in the management of facilities, logistics, as well as insurance business (less than 5% of its revenue)

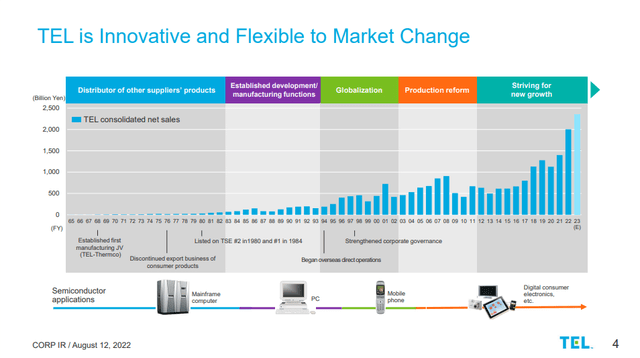

TEL has a history of significant growth, starting as a distributor of other companies' products, then becoming a manufacturer itself, and developing more advanced technology and products until it became one of the most important companies in the global semiconductor production equipment market.

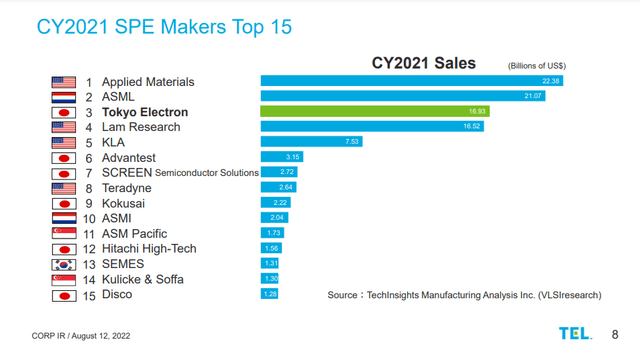

The company today competes with the likes of Applied Materials (AMAT) and Lam Research (LRCX) in the global semiconductor production equipment market, but not as much with ASML (ASML), which specializes in Lithography.

TEL's strength lies in its broad equipment portfolio covering four sequential processes that are critical for semiconductor manufacturing: deposition, Coater/Developer, etch, and cleaning.

Its products in these areas rank either first or second in global market share. In fact, Tokyo Electron's Coater/Developer for EUV lithography has a 100% share of the worldwide market.

To summarize the company and its strength; virtually every semiconductor in the world passes through one of its systems.

Table of Content

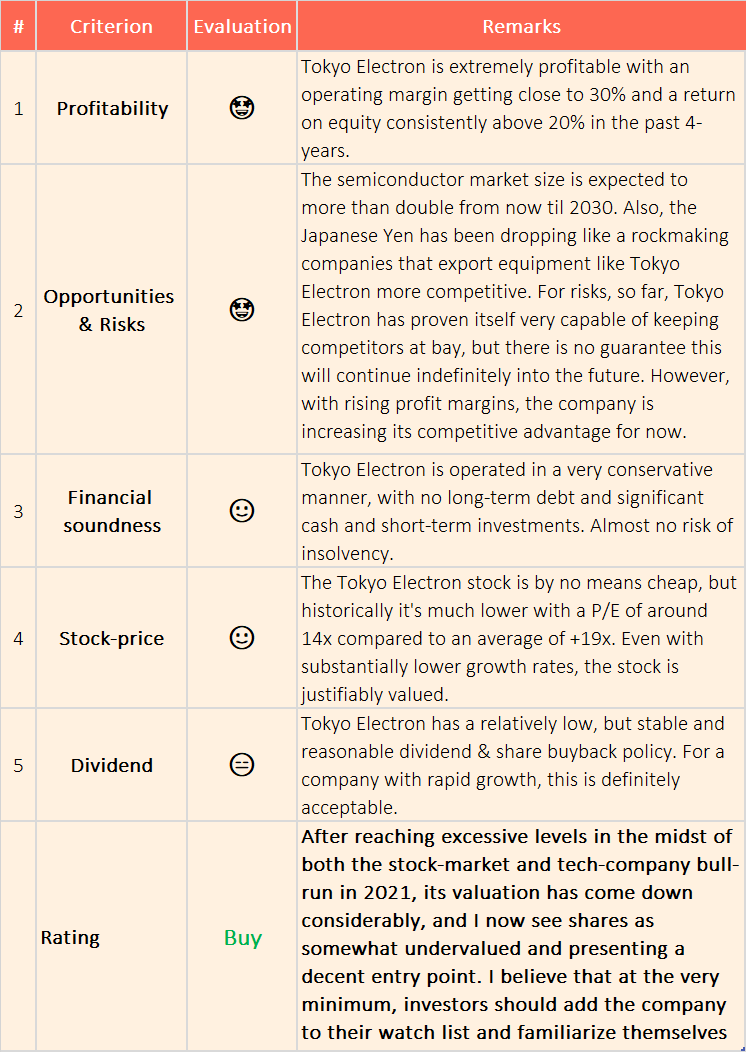

0. Konichi-Value Score

🤩 = Amazing

🙂 = Good

😑 = Acceptable

😖= Bad

1. Profitability

Tokyo Electron Q1 FY 2023 Results

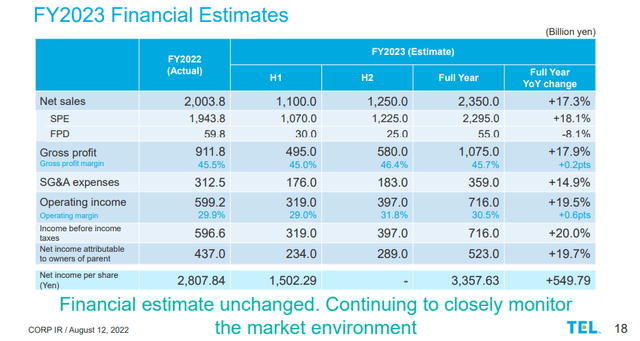

TEL's Q1 2023 (April 2022-June 2022) revenue was up 5% year over year, less than expected and mostly due to supply chain challenges. Despite this setback, TEL maintained its growth outlook for the year at above 17%!

As other companies in its industry have done, management lowered calendar 2022 wafer fab equipment growth expectations from 20% to a range of 5%-15%. It is likely that many of the orders are not fulfilled this year due to supply chain issues will move to calendar 2023. Hence, even though sales are lower than expected this year, the already laid orders will likely prop up the sales figures as soon as supply chain issues are fixed.

Financials

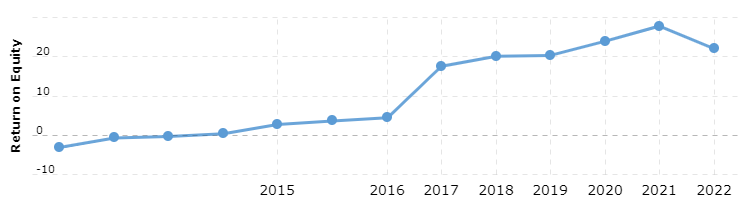

The quality of the business is reflected in its terrific profit margins and returns on capital. With operating profit margins that are getting close to 30% at its current growth rate of 17%, this is a particularly attractive business.

As expected in the semiconductor industry, there has been some historical volatility, but the company tends to remain profitable even during downturns. At least that has been the case since 2014, and as semiconductors go into more types of devices, the cyclicity appears to be moderating.

Looking at the Return on Equity (ROE), we can see why Tokyo Electron is a powerful investment compounding machine, as its ROE is extremely high. So, any retained earnings can be quickly compounded by the business.

Overall, TEL is extremely profitable with an operating margin getting close to 30% and a return on equity consistently above 20% in the past 4-years.

2. Opportunities & Risks

Opportunities

Market

The semiconductor market size is expected to exceed about $1 trillion by 2030, more than doubling the level in 2020, which was around $440 billion. This is a huge tailwind for semiconductor production equipment manufacturers, and TEL's role in the industry is becoming more critical than ever.

Based on calendar year 2021 sales, Tokyo Electron is a top 15 semiconductor production equipment manufacturer, in position 3 just behind ASML.

Currency tailwinds

The Japanese Yen has been dropping like a rock, making shares of Japanese companies more affordable, and making companies that export equipment like Tokyo Electron more competitive.

In fact, in the latest earnings projections, TEL has pegged 1 US dollar to 115 yen while the conversion rate now is much closer to 150 yen. Hence, we can expect revenues outside Japan to be much higher than projected.

On top of that, as over 50% of Tokyo Electron’s production value comes from Japan, its production costs have decreased substantially as inflation and salary increases are still low in Japan.

Guidance

The company is guiding for strong growth for FY 2023, expecting net sales to increase +17.3%, and operating income +19.5%. These are impressive growth rates and the reason that make Tokyo Electron so attractive right now.

The question is how long can it sustain this impressive growth, and what impact will the looming recession have? While the depth of the recession is still unknown, I do believe the current industry dynamics are very favorable and could help drive growth for a few more years.

Risks

As TEL operates in a very profitable segment of the market, there are many companies trying to outmaneuver them technologically, or with better business execution.

So far, TEL has proven itself very capable of keeping competitors at bay, but there is no guarantee this will continue indefinitely into the future. If competitors outperform TEL's technology, the company's attractive financial profile could quickly deteriorate, including its impressive growth and profitability.

However, looking at the company’s historical profit margins, which have so far increased substantially in the past 8 years, it is safe to say that TEL is likely increasing its competitive strength.

3. Financial Soundness

As is the case with many Japanese companies, it is operated in a very conservative manner, with no long-term debt and significant cash and short-term investments. I am therefore not worried at all about the liquidity available to the company.

In fact, increasing interest rates and costs of loans might be favorable for TEL as it can afford to fund its own investments, something that competitors cannot.

4. Stock-price

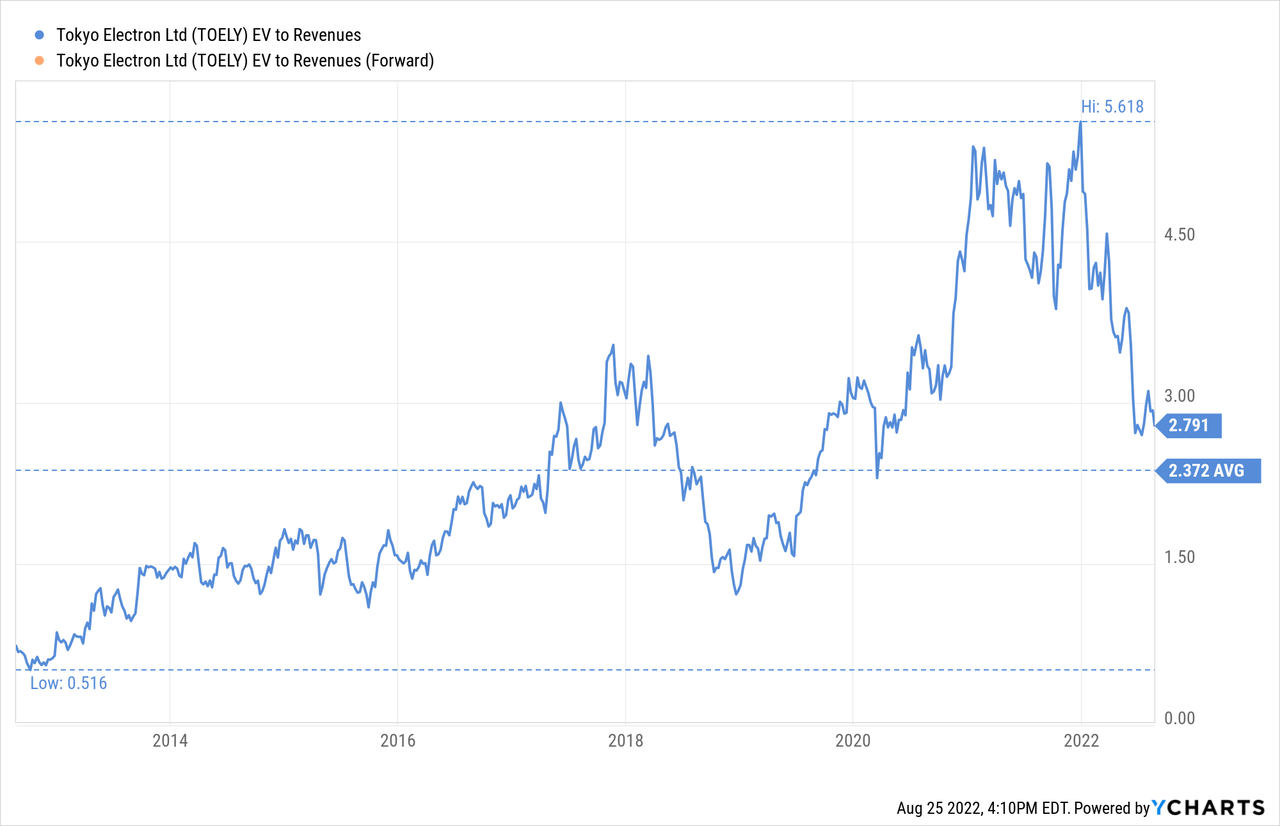

Shares became expensive after the Covid-19 pandemic, reaching an extremely high 5.6x Enterprise Value/Revenue multiple (EV/Revenue). Since then, shares have come back down to more reasonable levels, and right now are trading close to the 10-year average for this indicator.

Recently, there is significant fear regarding the semiconductor market, with some companies that have recently reported earnings being a little more cautious, which is resulting in lower valuations. This fear seems to be driven by an overall fear in tech and supply chain issues than anything connected to TEL.

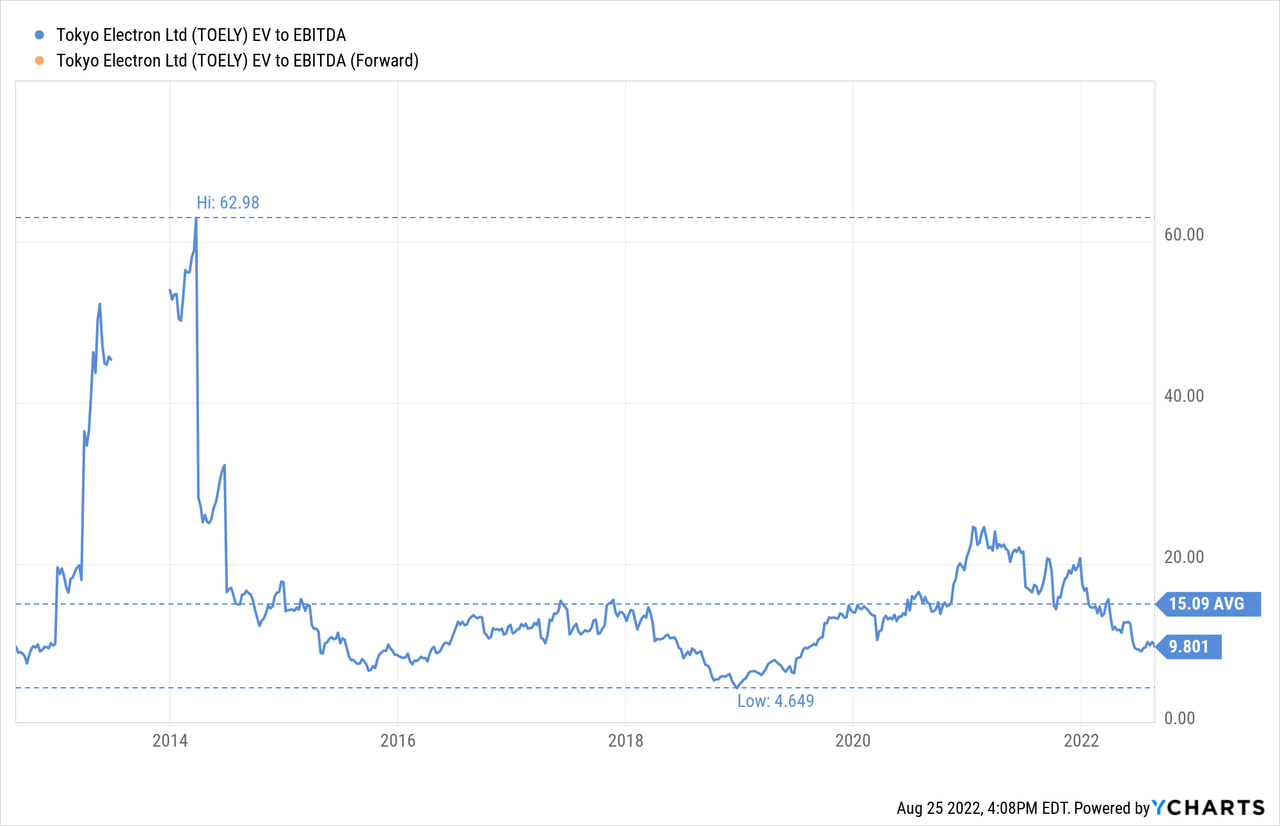

The EV/EBITDA is also quite reasonable, currently at less than 10x, and at a wide discount to the ten-year average of 15x.

Price-to-Earnings Ratio

Regarding TEL’s Price/Earnings (P/E) ratio, it’s 14.36x when writing this analysis, which is definitely acceptable for a company with a historical growth rate of around 18%. Also, it is historically low thanks to rapidly increasing profits and a bearish sentiment on the Japanese stock-market.

Looking at my motivated P/E matrix (here), we can see that the motivated P/E for TEL’s with a profit growth of 18% and a required rate of return of 15% is around 18-20x. Even if the profit growth is slashed by half due to present market conditions, we can motivate its present P/E of 14.36x if we lower our return expectations to 10%.

The Tokyo Electron stock is by no means cheap, but even with substantially lower growth rates, the stock is justifiably valued.

5. Dividend & Share-buybacks

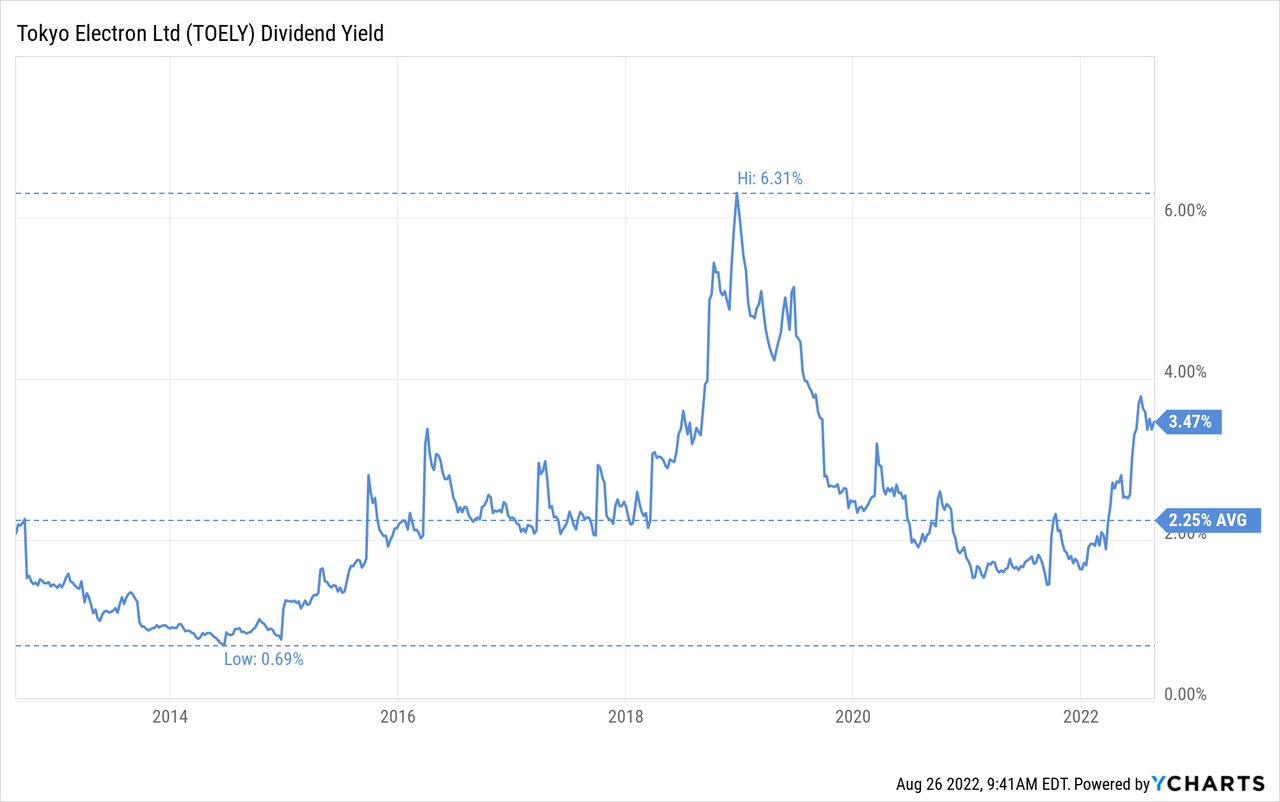

The dividend yield is currently about 3.5%, higher than the 10-year average by a significant margin.

The company has a policy to pay ~50% of its earnings as dividends, so as profits are likely to fluctuate a lot in the coming quarters, the dividend will likely also change a lot. Hence, this is not a stock for people searching for a stable dividend increase YoY.

Over the past three years, Tokyo Electron has bought back 1.7% of its shares. This is not a massive share buyback program, but it shows that the company is willing to prop up its share price after reinvesting into its core business.

Overall, Tokyo Electron has a relatively low, but stable and reasonable dividend & share buyback policy. For a company with rapid growth, this is acceptable.

6. Conclusion

Tokyo Electron does not get the attention it deserves, despite being one of the most important semiconductor production equipment manufacturers in the industry, with cutting-edge technology that touches basically every chip produced around the world.

After reaching excessive levels in the midst of both the stock-market and tech-company bull-run in 2021, its valuation has come down considerably, and I now see shares as somewhat undervalued and presenting a decent entry point. I believe that at the very minimum, investors should add the company to their watch list and familiarize themselves more with it.