[Stock-Analysis] NITORI : The IKEA of Japan on its way to World Domination

With the growth Nitori is achieving, it might soon be larger than its arch-nemesis, IKEA

Disclaimer: The information in this article represents my opinions. It should not be construed as individualized investment advice and is subject to change.

Nitori is Japan's largest furniture and interior retailer. The company is often referred to as the Japanese IKEA with its strategy of offering packaged furniture the customers assemble.

Nitori's products are known in Japan for their good quality and reasonable prices. In fact, they are often touted for using sturdier material and simpler installation than IKEA. Also, as Nitori is a public company, you can invest in its stock; something that you cannot do with IKEA.

In this article, I will analyze Nitori's business performance, financial details, and the stock price, and ask whether the current stock price is attractive.

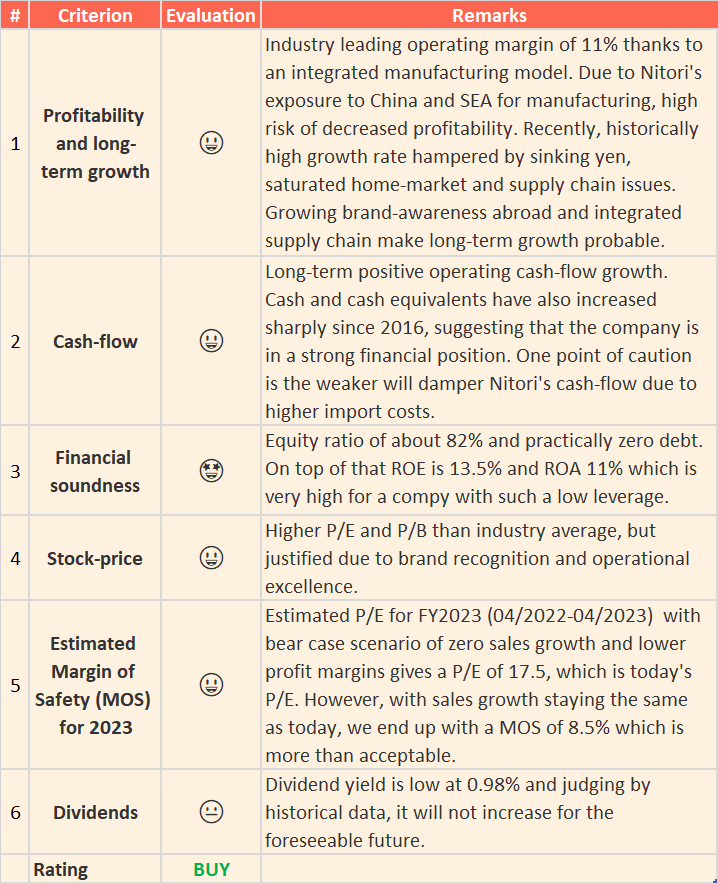

Konichi-Value Score

Nitori's investment criterion are summarized in the table below. Each criterion is evaluated on a four-grade emoji scale:

🤩 = Perfect

😃 = Good

😐 = Acceptable

😢 = Bad

My six analysis criteria:

Nitori’s business: Profitability and long-term growth

Is Nitori cash-flow abundant?

Is Nitori financially sound?

Is Nitori’s stock undervalued?

Estimated margin of safety (MOS) FY 2023

Does Nitori provide good dividend?

Summary

Based on the above 6 points, I have examined whether Nitori is a stock you should sell, hold, or buy.

Keep reading with a 7-day free trial

Subscribe to KonichiValue Japan to keep reading this post and get 7 days of free access to the full post archives.