[Stock-Analysis] muRata Manufacturing: Parts-Provider to Apple & Likely Winner of the Manufacturing Boom in Japan

Disclaimer: The information in this article represents my opinions and should not be construed as individualized investment advice, and are subject to change.

All the stars are aligned for Japan to once again reclaim the title as a manufacturing powerhouse: The country is the most politically stable country in Asia, Japanese salaries have stayed basically stagnant since 1992 and the Japanese yen has lost almost 40% in value to the US-dollar in less than a year. All this is happening while companies are fleeing the from the world’s largest manufacturer, China, due to political turmoil, Covid-lockdowns and rapidly increasing salaries.

One company that looks to truly benefit from this trend is Murata Manufacturing, one of the world leaders in electronic component manufacturing:

Overview

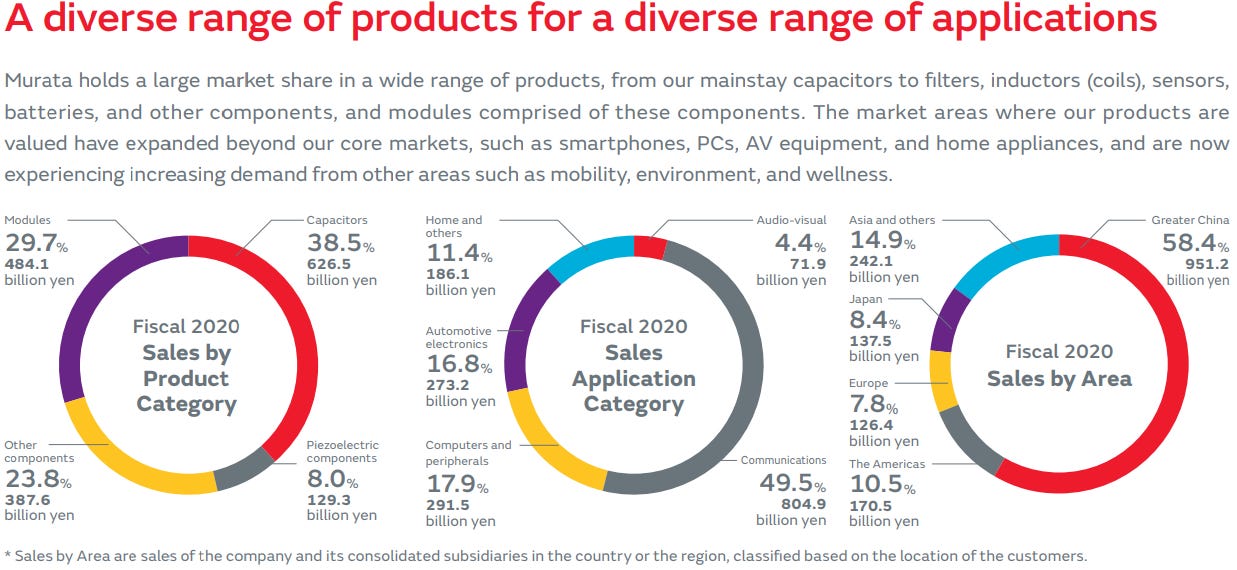

Murata Manufacturing (6981 JP) manufactures and sells electronic components for electronic devices such as smartphones, PCs, and automobiles. The company’s main products are capacitors (see description in image below) and but it also provide components such as inductor coils and filters. Many of its products have global reach, and are crucial to most smartphones, especially the Apple iPhone, but also to cars, IoT products and wearables.

Murata is exceedingly reliant on global sales with overseas sales ratio exceeds 90%. As of the end of March 2022, the company is developing its business with a wide network of 29 domestic affiliates and 60 overseas companies.

By application, telecommunications accounts for 43% of sales and mobility accounted for 18.6%. In terms of sales by region, Greater China accounts for 54.8% (down from 58.4% in 2020), and it seems that the ratio is increasing because Apple owns a factory in China. Attention should also be paid to developments in China and Murata is very aware of its risks. In fact, they have cancelled some new factory build-outs in China in favor of focusing on its Japanese manufacturing arm.

Konichi-Value Score

🤩 = Amazing

🙂 = Good

😑 = Acceptable

😖= Bad

Table of Content

Profitability

Opportunities and Risks

Financial soundness

Stock-price

Dividends & Share-buybacks

Conclusion

Keep reading with a 7-day free trial

Subscribe to KonichiValue Japan to keep reading this post and get 7 days of free access to the full post archives.