[Stock-Analysis] HAMAKYOREX (9037 TYO): A Robotics-Focused Shipping Company with a P/E of 8

While companies like UPS is trading with a P/E of 14.18; Hamakyorex handles shipping, logistics and still has a P/E of 8. In this stock-analysis, I will show you why.

Disclaimer: The information in this article represents my opinions and should not be construed as personalized or individualized investment advice, and are subject to change.

Hamakyorex Co., Ltd. <9037.T> is an independent logistics and shipping contractor, which in Japan is referred to as a 3rd Party Logistics (3PL) company. Think of a combination of an Amazon warehouse and FEDEX/UPS shipping service that is usable by any company that wants to distribute their products.

Over the years, the company has manage to achieve steady growth and revenue, all while improving its efficiency with robotics and other automation focused initiatives. Still, the company’s Price-to-Earnings ratio (P/E) has been hovering around 8-9 for the past 10 years!

Is Hamakyorex a diamond in the rough, or are there any dirty secrets hidden beneath its façade? Let’s find out in this week’s Konichi-Value stock analysis:

Overview

Hamakyorex was founded in 1971 and is headquartered in Hamamatsu, Japan. The company engages in logistics center business Japan and internationally. It offers logistics and shipping services for various products, including apparel, medical device, cosmetics, bedding and furniture, food, and joint logistics services, as well as miscellaneous cargo flow services. It also provides general freight vehicle transportation services.

The company’s business revenue structure is divided in 60% logistics center engagements and 40% Trucking Business Deals.

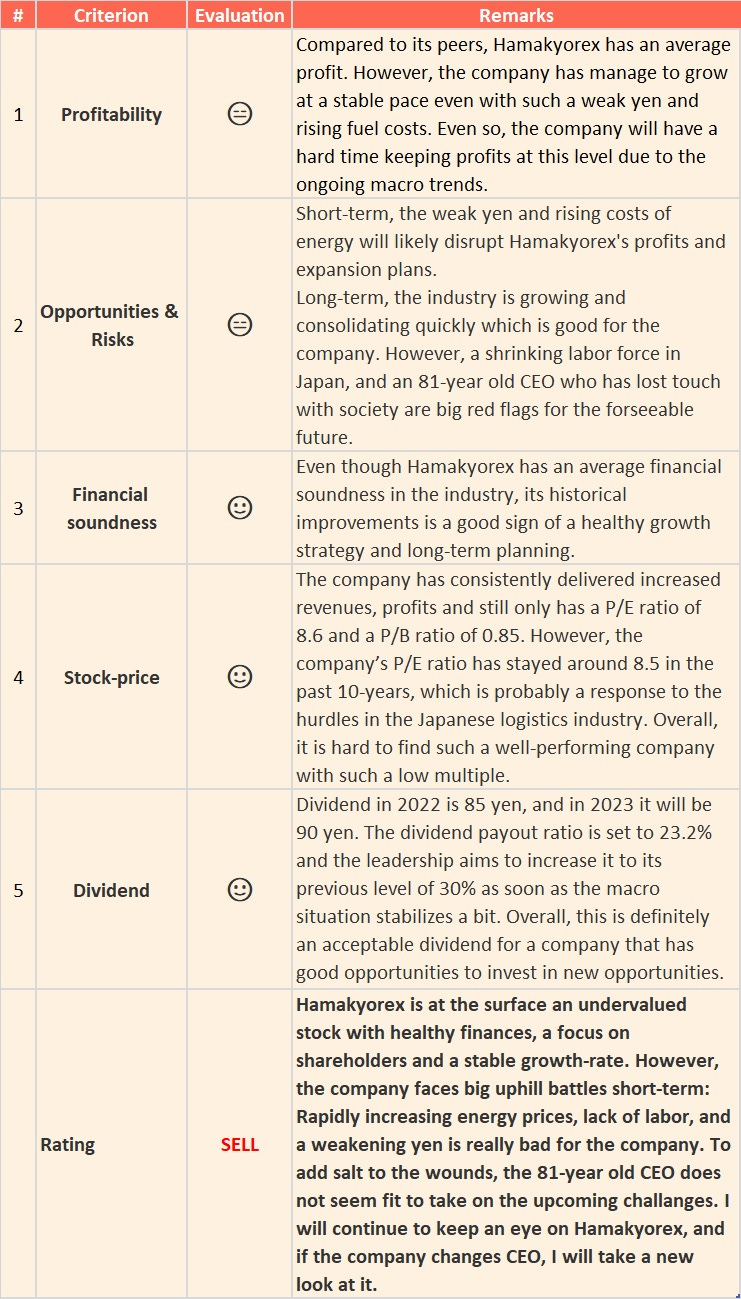

Konichi-Value Score

Table of Content

Profitability

Opportunities and Risks

Financial soundness

Stock-price

Dividends

Keep reading with a 7-day free trial

Subscribe to KonichiValue Japan to keep reading this post and get 7 days of free access to the full post archives.