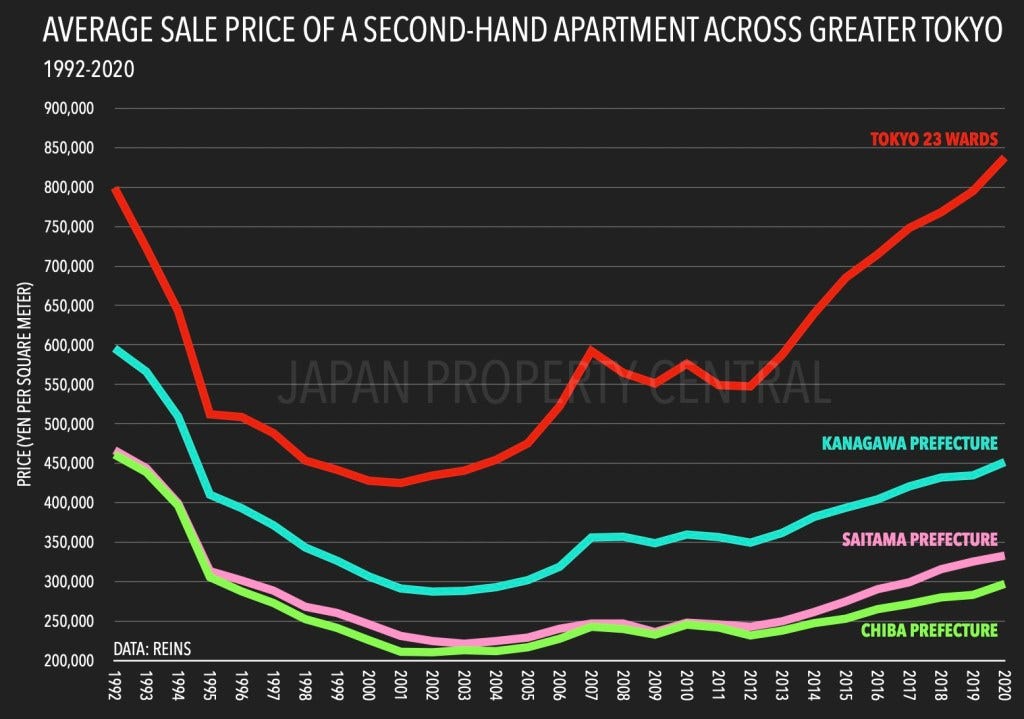

Housing prices in Tokyo have risen by approximately 5% since 1992, and in almost all other areas in Japan, housing prices have fallen…

The graph below shows the development of second-hand apartments in Tokyo since the Japanese asset price bubble burst in 1992:

This graph becomes especially abysmal when compared to other countries:

From 1992 to today, the average property prices in London have increased by 593% (UK Land Registry Data) or 640% in New York City (Data from Zillow & GO Banking Rates).

However, this may all be about to change…

Foreigners are going crazy for Japanese real estate!

In 2021, the amount of investment by overseas investors reached 1,330 billion JPY, an increase of 30% from the previous year. This is the first time in history the investment amount from foreigners has exceeded 1 trillion JPY.

Have foreigners gone crazy, or is the Japanese real estate market becoming a good investment?

In this 2-part series , I will help you decide if you should invest in the Japanese real estate market by giving you:

Part-1: Three Arguments for Buying Real Estate in Japan”, and

Part 2: Three arguments against buying Real-Estate in Japan

Arguments For Buying Real Estate in Japan:

#1 Real Estate in Japan is Dirt Cheap!

First of all, the Japanese Yen (JPY) has dropped approximately 30% to the US Dollar in less than half a year! That basically gives most foreigners with stable currencies a 20-30% discount on Japanese properties.

Secondly, real estate in Japan have been comparatively cheap for a long time:

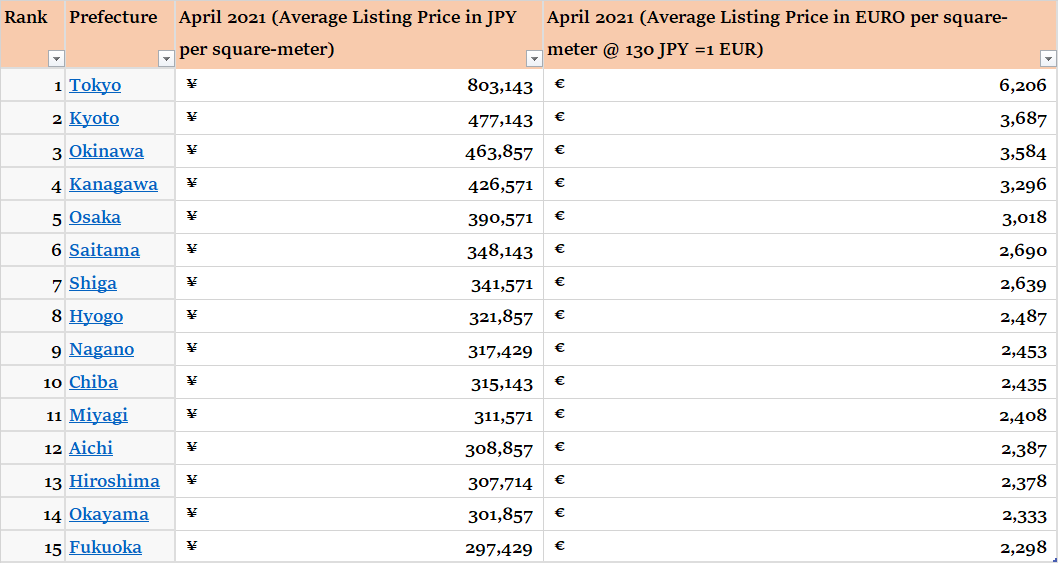

Below is a list of the average price per square-meter in the 15 most expensive prefectures in Japan:

Compared this to the 16 most expensive cities in Europe:

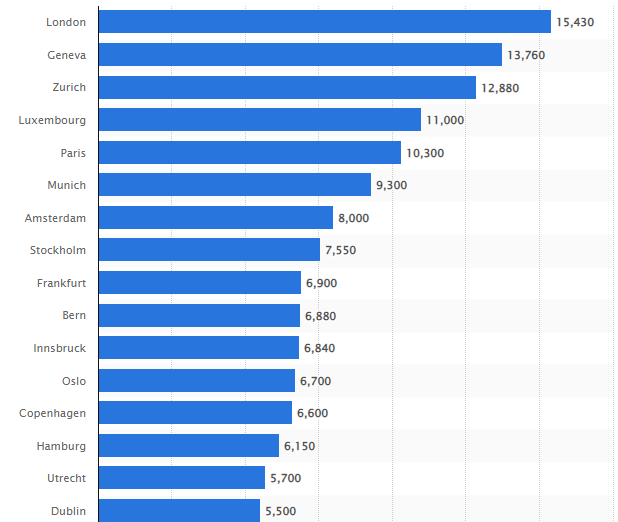

Average cost of an apartment in Europe in the 1st quarter 2021, by city (in euros, per square-meter):

As you can see from the two tables, only Tokyo has square-meter prices that can even measure themselves with the 15 most expensive cities in Europe. And housing prices in Tokyo are barely more expensive than Hamburg!

2# Investment Yields in Japan are Surprisingly Strong

First, I made a crash-course in real estate yields that you should check out HERE before reading this section.

In summary, real estate yield is a measurement of future income on an investment based on how much you paid for it. There are two types of yield, Gross yield and net yield.

Gross Yield = annual rent income ÷ property purchase price

Net Yield = annual rent income ÷ (property purchase price + costs at the time of purchase + annual cost)

Since net yield gives us a much better estimate of how much yield you’ll actually get from your real estate investment, it is what this article will use.

How do Japanese real estate yields hold up against other countries?

Well, pretty good it turns out.

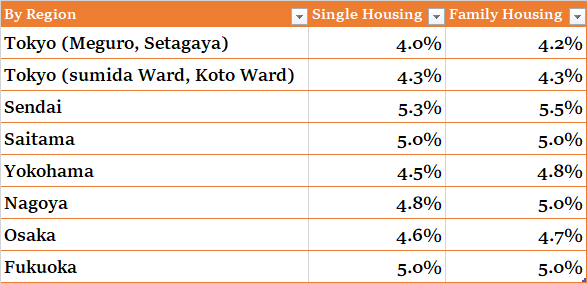

In fact, historical investment yield in Japan’s major cities are much stronger than many other “real estate heavens” :

This means that if you buy an apartment in Fukuoka for JPY 10,000,000 ($78,079) and sell it after 10 years for the same amount, you would still make JPY 6,288,946.27 in pure profits (requires you to reinvest your yield in new properties)

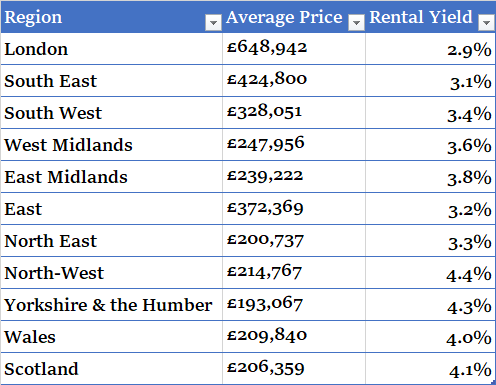

For reference, take one of the hottest real estate markets in Europe, the United Kingdom:

Japan looks even more attractive compared to its neighbors.

If you take the only two places foreigners can practically invest real estate in Asia, Hong Kong & Singapore, their net yields are:

Hong Kong: 2.3%

Singapore: 3.3%

*Source: Global Property Guide (2021)

In summary, the Japanese real estate market is extremely attractive in Asia. Even in most of Europe and the US, which traditionally have had the most attractive real estate yields, Japan is definitely a contender.

3# Foreigners can own Properties in Japan

Japan not only allows foreigners to buy properties, they also permit land ownership.

In fact, you’ll have the same rights as Japanese citizens when it comes to owning any type of real estate, whether it’s a mansion in Tokyo or an apartment in Okinawa.

That’s a rare attribute in Asian markets. Most countries in the region only let foreigners buy condo units. In fact, many Asian countries won’t let you own real estate at all.

China and Vietnam, for example, don’t allow anything more than a long-term lease on any kind of property. Even Thailand, a very hot property market for foreigners, only allow them to hold apartments if the contract is held by a Thai citizen.

Hence, Japan is one of the safest and easiest countries in Asia to buy real estate as a foreigner. There’s practically zero distinction between foreigners and Japanese citizens when it comes to owning any type of property.

Disclaimer: Owning property or land in Japan does not give foreigners any visa benefits. To be able to live in your property full-time, you still need a work- or spouse visa.

In Summary

As this article has shown you, Japanese real estate is dirt cheap, investment yields are comparatively high and most importantly, foreigners are allowed to own both properties and land.

Since the Japanese asset bubble burst in 1992, property prices have not recovered which has resulted in its real estate market being overlooked by investors for decades.

However, foreigners are finally waking up to this overlooked market. As foreign real estate investments in Japan have exceeded 1 trillion JPY for the first time in history, now is probably a good time to step in!

With that said, there are many downsides with investing in real estate in Japan, but more on that in Part 2: Three arguments against buying Real-Estate in Japan.

Share this post