[Real-Estate] Home-Loans in Japan are Ridiculously Cheap - How to Take Advantage of Them

With variable-rate morgages still as low as 0.3%, Japan has the cheapest rates in the world! In this post, I cover why and how you can apply for one

*The terms “home-loan” and “mortgage” are used indiscriminately in this article

Table of Content

Click on each title to go straight to that section

1. Why home-loan rates are increasing rapidly worldwide

The world has seen the highest inflation in decades which have pushed central banks to raise interest rates to new heights. The US central bank, the Federal Reserve, has raised its interest rates to 4% and it’s predicted to reach 4.5% in the coming months.

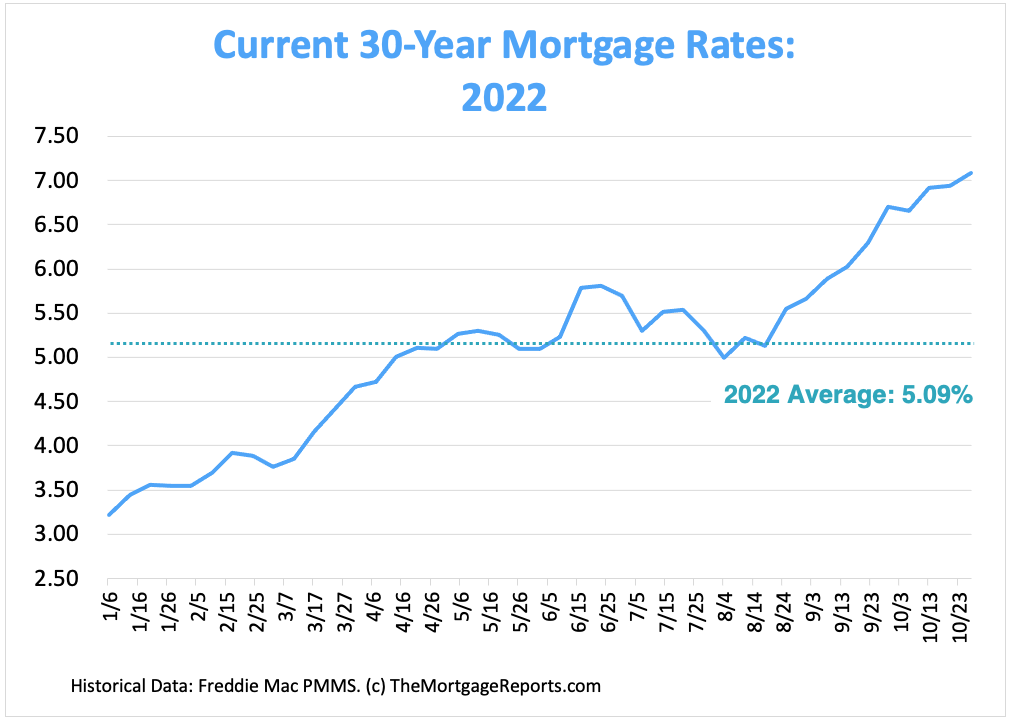

This has had a tremendous effect on home-loans. The interest rate on an average 30-year fixed-rate mortgage have gone from 3% to over 7% just this year. That’s a 130% increase in interest payments for new home-buyers!

In Europe, variable mortgages are more common, which means that homeowners are already getting crushed by rising interest payments.

In my home-country of Sweden, interest rates have climbed from 1% to 4% this year, meaning that the average homeowner’s interest-rate payments have increased by 300% since January (SBAB Swedish home-loan newsletter)!

In the UK, interest-rates are forecasted to rise well beyond the average household’s disposable income, which will likely result in a massive increase of personal bankruptcies.

2. Why home-loans are so cheap in Japan

While housing markets worldwide have begun to collapse, the Japanese housing-market is doing just fine.

With inflation modest compared to other nations and the economy still below pre-pandemic levels, the Bank of Japan (BOJ) has signaled that there are no plans to tweak its pledge to keep rates at current or lower levels.

Despite Japan’s ultra-low interest rate environment, fixed-rate mortgages have increased in the last 10 months, indicating that Japanese banks are not completely insular to global inflation pressures, but compared to other countries, mortgage-rates are still very low.

If you go on Japan’s No.1 home-loan website, Kakaku.com, you’ll likely cry your eyes out if have a home-loan from another country…

For morgages with variable interest-rates, you can still get rates under 0.3%!

A. Most popular variable-rate mortgages in Japan:

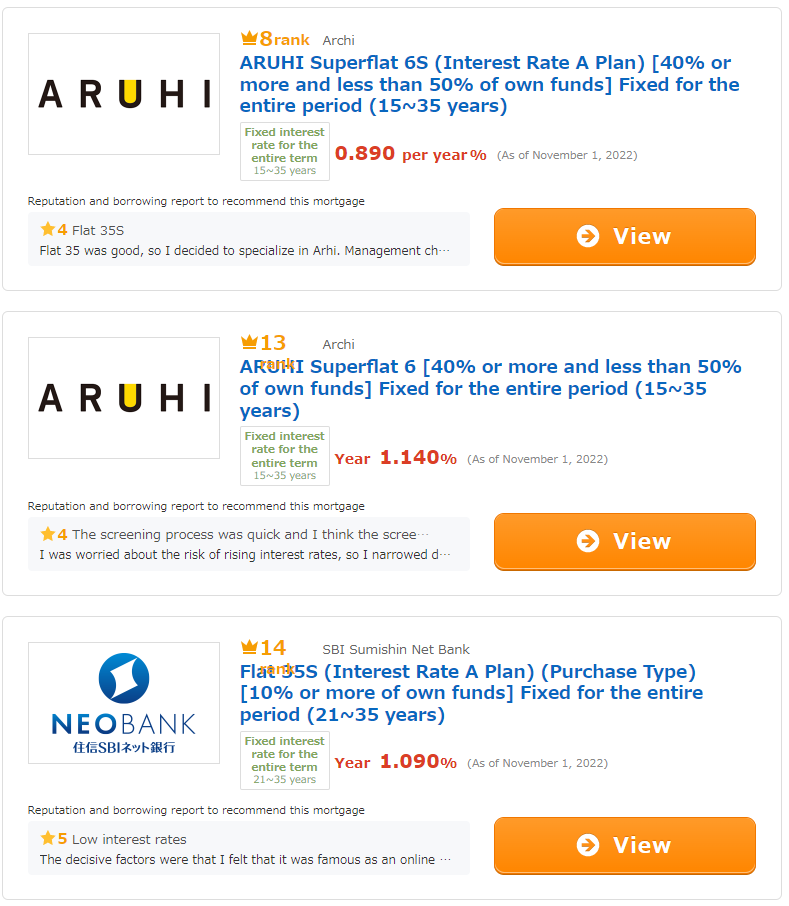

Even for 30-year fixed-rate morgages, the rates are ridiculously low.

B. Most popular 26-35 years fixed-rate morgages in Japan:

It seems that even long-term, Japanese banks are certain that inflation and interest rates will remain low.

3. How to qualify for a Japanese home-loan as a foreigner

Keep reading with a 7-day free trial

Subscribe to KonichiValue Japan to keep reading this post and get 7 days of free access to the full post archives.