[Stock-Analysis] Z Holdings (4689 TYO): The Secretive Owner of Yahoo! Japan, Line, ZOZO & PayPay

Z Holdings has lost over 40% of its share-price YTD, but its P/E is still around 40x. Is the stock misunderstood, or still too expensive?

Before you dive into this article, I want to say that it has been my toughest analysis yet. Z Holdings is an incredibly complex company that is very secretive about many of its operations. I have done my best to cover every relevant part of its business to give a fair assessment about its share-value, but be aware that some areas might be missing.

TL;DR

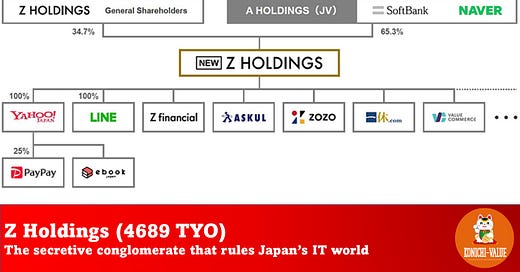

Z Holdings, formerly known as Yahoo! Japan, is a holding company partly owned by SoftBank Group and Korean NAVER that operates Yahoo! Japan, LINE, ZOZO, PayPay, and ASKU.

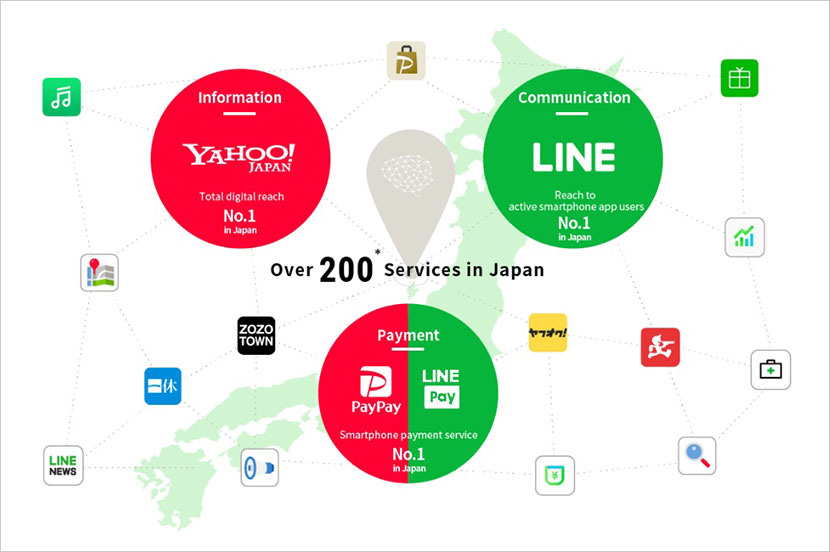

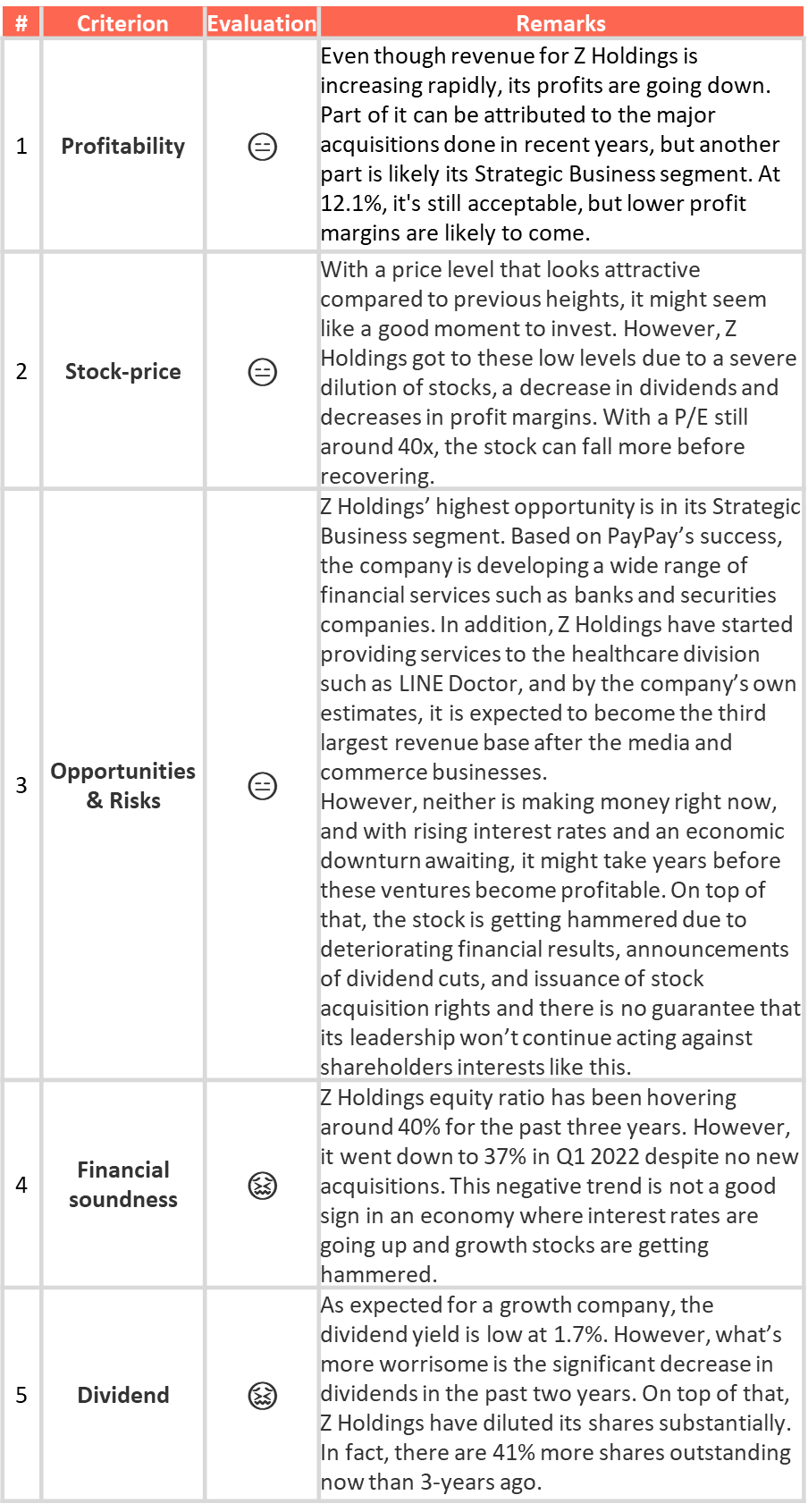

The company is divided in three main pillars: Media Business, Commerce Business, and Strategic Business. The Media Business is the company’s profit generator, the Commerce Business the revenue generator and Strategic Business its loss-maker.

Business integration with LINE in March 2021 has greatly increased Z Holdings revenue but has likely decreased its operating margin. On top of that, Z Holdings Strategic Business segment is continuing to be a loss-maker due to costs of expanding PayPay and new ventures such as Line Doctor.

The stock price continues to decline partly due to the issuance of stock acquisition rights, a decrease in dividend and further decrease in operating margins.

The stock might look cheap at JPY 390, but with its issues and a P/E of 40x, it can still fall a lot before hitting its bottom.

What is Z Holdings?

You might not have heard of Z Holdings (4689 TYO), but you definitely recognize its former name, Yahoo! Japan Corporation. Yahoo! Japan was a separate entity from Yahoo US that was created in 1996 and over time, the US division gave up all control over Yahoo! Japan. In 2019, a regrouping of its assets and a separation from its parent, Softbank, led it to change its name to Z Holdings

Today, Z Holdings is partly owned by the SoftBank Group and NAVER and is mostly known in Japan by its brands such as Yahoo! Japan, LINE, ASKUL and its financial business PayPay.

Z Holdings has an aggressive growth-through-acquisition strategy: In May 2012 it acquired ASKUL, one of Japan’s largest office equipment supplier and logistics company, In November 2019, it acquired ZOZO Co., Ltd., which is famous for ZOZOTOWN (Japan’s largest online fashion retailer), and in March 2021, it acquired Japan’s largest chat-app, LINE Corporation.

Divided into three businesses

Z Holdings is divided into three main businesses: the Media Business, the Commerce Business, and the Strategic Business:

The Media Business is the company’s largest and most known segment with media-related services such as Yahoo! JAPAN, Yahoo! News, LINE stickers, and LINE GAME, as well as advertising businesses through Yahoo! JAPAN Ads and LINE Ads.

The commerce business is mainly related to sales, mainly of e-commerce through Yahoo! Shopping, PayPay Mall, ZOZOTOWN, ASKUL, LOHACO, LINE FRIENDS, AND LINE GIFT. In addition, various fields such as Yahoo Japan and Yahoo! Travel are classified as commerce businesses.

The strategic business is a fintech-related business, which is the company’s more speculative and growth oriented assets such as PayPay and Line Doctor.

Table of Content

Konichi-Value Score

🤩 = Amazing

🙂 = Good

😑 = Acceptable

😖= Bad

Konichi-Value Score and full analysis below

Keep reading with a 7-day free trial

Subscribe to KonichiValue Japan to keep reading this post and get 7 days of free access to the full post archives.